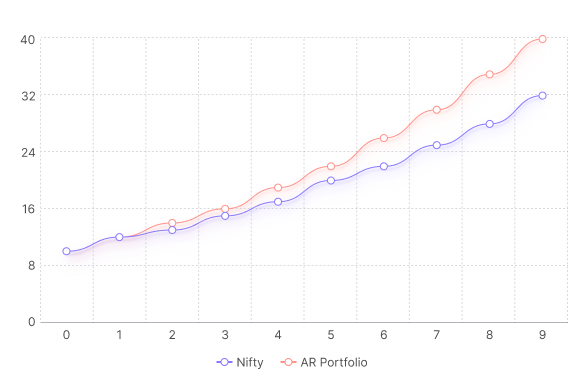

From data-driven decisions to multigenerational wealth planning, we go beyond transactions, we build lifelong financial partnerships.

Top Value Propositions

We offer client specific standardised wealth solutions, objective-driven wealth strategies that adapt to evolving life goals and dynamic market conditions.

We empower you with actionable insights and scenario models so you can make informed, confident financial choices aligned with long-term goals.

We go beyond returns. We help optimize taxes, safeguard wealth against liabilities, and plan for a smooth legacy transition.

With ₹99,008+ Cr in AUM, 13,262+ families served, and over 393 wealth professionals across 18+ cities, you gain access to India’s most trusted financial brain trust.

Define Objective

Define Objective Create Strategy

Create Strategy Implement with Conviction

Implement with Conviction Monitor & Course Correct

Monitor & Course Correct

.png)